Child Support in Alberta

What is child support?

Child support the money paid by one parent to the other parent to help support their child. Typically, child support is paid to the primary parent, although both parents may owe each other child support if they share parenting of the child.

Child support is based on two factors: first, the number of children. The more children, the more child support must be paid.

Second, the payor parent’s total income. The more a parent earns, the more child support they will pay. In most cases parents must pay exactly what the tables located in the Child Support Guidelines say.

Importantly, child support is available to both married and unmarried parents.

Why is there Child Support?

In Alberta, all parents have a legal responsibility to financially support their child. This remains true even when the parent does not spend any time with the child. This is because child support is the right of the child—not the right of the parent receiving child support. This means that parents cannot agree to forego child support.

Basically, child support is there to ensure that children benefit from the incomes of both parents, and ensure they have the best life possible.

Ongoing Child Support

According to the Federal Child Support Guidelines, there are two kinds of child support: Section 3 child support (monthly) and Section 7 (extraordinary) child support.

1. Base (Section 3) Child Support – Section 3 child support is a monthly payment made by the payor parent to the recipient parent. Section 3 child support covers the child’s “fixed” costs like food, clothing, shelter, and incidental expenses like toothpaste and toys.

The amount of monthly support depends upon the number of children and the payor parent’s income. Revenue Canada provides an online child support calculator which makes it easy for parents to see how much they may be obligated to pay.

In cases where parents share parenting of the children, the courts often order that each parent pays the other child support. The is allowed under Section 9 of the Guidelines. Overall, this results in a set off of the parent’s support obligations, so that the overall amount of support is reduced. For example:

John and Mary share parenting of one child. According to the Child Support Guidelines, John must pay Mary $1,000 per month. Meanwhile, Mary must pay John $500 per month. In this case, the amount owed by Mary would be set off against what John owes, such that John only pays $500 per month to Mary in child support.

Shared parenting does not always result in a straight set off of child support obligations. On a case-by-case basis, the Court may reduce support obligations by a different amount, after considering the following factors:

9(a) the amounts set out in the applicable tables for each of the spouses;

(b) the increased costs of shared parenting time arrangements; and

(c) the conditions, means, needs and other circumstances of each spouse and of any child for whom support is sought.

2. Extraordinary (Section 7) Child Support – This covers “special or extraordinary” expenses, which typically include:

-

- Childcare expenses that one parent incurs due to their employment, illness, disability, or education/training for employment (For example, daycare or babysitting).

- Medical and dental insurance premiums attributable to the child.

- Health-related expenses like orthodontic work, prescription drugs, or glasses.

- Extraordinary expenses for the child’s schooling, for example, if there were increased costs to attend a special German language program.

- Post-secondary educational expenses like university tuition. If the child is over the age of majority, then they will typically have an obligation to contribute something towards their own education as well.

- Extracurricular expenses like hockey registration fees and equipment or ballet lessons.

The amount that each parent contributes to a special expenses is based on their proportional incomes. For example, if mom earns $60,000 annually and dad earns $40,000 annually, then together they would earn $100,000. Therefore, the mom would pay for 60% of the expenses, while dad would pay for 40% of the expenses.

Child Support for Adult “Children”

A parent’s child support obligations do not always end when the child turns 18. An adult “child” may still be entitled to child support if they enroll in post-secondary education, or if they are unable to become independent from their parents for health or psychological reasons.

In this case, the Court will consider additional factors that are outlined in the leading case Farden v. Farden. These include:

- Is the child enrolled in post-secondary courses full-time or part-time?

- Is the child eligible for student loans or other forms of financial assistance like scholarships, grants, or bursaries? Have they applied for any forms of financial assistance?

- What are the child’s career plans? Is post-secondary education necessary for this plan, and is the plan reasonable?

- Can the child work part-time?

- How old is the child?

- Have they previously demonstrated success in the chosen course of study? Are they excelling in school?

- What plans have the parents made for the education of the child? Were these plans made during the relationship?

- Has the child completely terminated a relationship with the parent who is being asked to pay support?

These factors are considered by the Court in a holistic way, and it is best to talk to a lawyer about how they may apply to your specific case.

Retroactive Child Support (Arrears)

Can I Apply for Retroactive Child Support?

Parents can apply for child support retroactively, meaning that the court order would apply for a period of time in the past, rather than in the future. Both the payor and recipient parents are at liberty to apply for retroactive child support.

Typically, the recipient parent may wish to apply for a retroactive child support order because they are entitled to more money. This occurs in cases where the payor parent refuses to pay, or refuses to pay enough. The recipient parent may also apply for retroactive child support for reimbursement for Section 7 expenses in the case where the payor parent refuses to contribute.

On the other hand, the payor parent may want to apply for a retroactive child support order to reduce their obligations or arrears. This usually occurs in cases where the payor parent has lost their job, earns less than they did when the order was granted, or believes that the recipient parent should pay more for their share of the Section 7 expenses.

Often, these applications go hand-in-hand with an application for a “stay of enforcement” from the Maintenance Enforcement Program (“MEP”).

How Retroactive Child Support Works

The Court has the authority to recalculate a parent’s child support obligations retroactively. How far back the Court will go depends on two dates: the date of effective notice and the date of formal notice.

Effective Notice refers to the first instance in which the parent applying for the retroactive support notified the respondent parent that the child support amounts should be renegotiated. There is no specific form to provide effective notice. In fact, a simple conversation or text message may be sufficient. However, remember that it can be difficult to prove a conversation occurred if it is not documented in writing.

Formal Notice means the date when the parent applying for retroactive child support filed their claim in court.

Typically, the Court will recalculate retroactive child support obligations back to the date of effective notice, provided that this date is no more than 3 years before the date of formal notice.

The reason for this is that the Court is attempting to balance the rights of the recipient parent to a fair level of child support with the rights of the payor parent to certainty. Basically, the Court will make retroactive awards, but will not let the applicant sit on their hands for more than 3 years.

Making a Retroactive Support Application

The Court may go back even further in certain situations, after considering the following factors:

- Did the applicant parent have a reasonable excuse for not bringing their application sooner? Reasonable excuses can include poverty, inadequate legal advice, insufficient knowledge of the payor parent’s income, reasonable fear that the payor parent may harm them or the family, or threats/intimidation from the payor parent.

- Did either parent engage in blameworthy conduct? For example, did one of the parents hide or fail to disclose their income, mislead the other parent into believing their child support obligations were met, or intimidate the other parent into accepting a lesser amount of child support?

- The child’s circumstances. In particular, was the child deprived by the lack of support, and did they benefit financially in a different way?

- Any hardship incurred by either parent. For example, having to repay a large lump sum of child support may be onerous. In these circumstances, the Court will often order that retroactive child support be repaid on a monthly basis.

These factors also apply to a parent who applies to the Court to reduce their overpayment of child support. However, in these cases the requirement of effective notice requires that the payor parent clearly communicate their change in circumstances and disclose documents showing that their income has changed.

For example, a payor parent seeking to reduce their child support arrears may need to provide a copy of their Record of Employment or Tax Return to the recipient parent in order to meet this threshold.

Importantly, the Court will not reduce arrears simply because they are high. Instead, the Court is more likely to simply restructure the payment schedule.

The Court may completely vacate arrears in very rare cases, where the payor parent is unable to ever repay the arrears. Typically, this requires the payor parent to show that they are medically unable to work now or in the future.

How is Child Support Calculated?

Calculating child support is not complicated, but there are a number of steps involved.

Step 1 – Determine the Parenting Arrangement

In a primary parenting arrangement, the primary parent receives monthly (Section 3) child support from the other parent. In a shared parenting arrangement, both parents typically receive monthly (Section 3) child support from the other. Often, these amounts are set off, so that only one net payment is made. The Court is able to do this under Section 9 of the Child Support Guidelines.

In both parenting arrangements, the parents split the extraordinary (Section 7) expenses on a proportional basis.

Step 2 – Determine the Parent’s Income

In order to calculate the amount of child support payable, we need to know both parent’s gross annual incomes. In order to do this, the parents will need to exchange financial information. This is usually done voluntarily, however, if a parent refuses to provide their information, then you may need to file a ‘Notice to Disclose’ Application to compel them to provide their information.

Typically, income will be determined by looking at the payor’s most recent tax returns or notices of assessment, and their most recent paystubs. If a parent is self-employed, then it may be necessary to review their corporation’s financial statements, general ledgers, and bank records.

If it is not possible to accurately determine the payor’s income, then the court will impute the payor with an income that it deems reasonable under the circumstances. The court may also impute incomes in situations where a payor is deliberately underemployed or unemployed. For example, if a surgeon quits his job to become a barista because he no longer feels like paying so much in child support, he may still need to pay child support based on the surgeon’s income.

Step 3 – Calculate Monthly (Section 3) Support

Revenue Canada provides an online child support calculator which can provide parents with their estimated monthly obligations. However, you should speak with a family lawyer before finalizing an agreement, or applying for an order, because the lawyer will have access to the latest child support software.

Step 4 – Calculate Extraordinary (Section 7) Support

Parents will need to compile all of their receipts for any valid special expense. These receipts are then submitted for reimbursement from the other party, based on a proportional split. It is important that your child support order specifically mentions which Section 7 expenses are applicable, because otherwise it will be difficult to enforce an expense.

Step 5 – Consider Enrolling in the Alberta Child Support Recalculation Program

The Alberta Child Support Recalculation Program is a free service offered by the government which automatically recalculates simple child support orders annually, based on the new year’s financial information.

This program is helpful for parents who work as employees, however, it is not available for parents who are self-employed, or earn significant amounts of income from non-employment sources (like dividends or capital gains).

How is Child Support Enforced?

In Alberta, child support orders are often registered with the Alberta Maintenance Enforcement Program (“MEP”). MEP is an Alberta government initiative that automatically enforces orders and agreements relating to child support, spousal support, and partner support.

Once an order or agreement is registered with MEP, they will handle all of the collections actions. For example, if a parent stops paying child support, MEP may seize their bank accounts, garnish their wages, or suspend their driver’s license until they resume making payments.

Stay of Enforcement

Sometimes the payor parent will lose their job due to injury, illness, or economic/business reasons. They may also take a new job that pays less than the old one so that they can spend more time with the kids. Unfortunately, MEP will still continue to enforce the payor’s child support obligations until there is a new court order in place.

It may take months to get before a judge. In that case, the payor parent may need to a apply for a stay of enforcement from MEP.

A stay of enforcement will temporarily prohibit MEP from taking enforcement actions against the payor. A stay of enforcement may be granted for a maximum of 9 months, and the payor may still need to make smaller payments in the meantime.

Contact an Alberta Child Support Lawyer Today

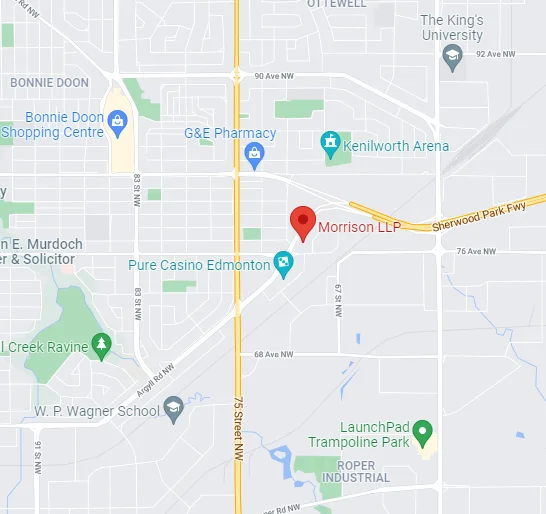

If you are in need of child support, or have lost your job and are paying too much, feel free to call a family lawyer at Morrison LLP at 587-758-1099 to speak about your child support matter. The first 30 minutes are free.

Although we are based in Edmonton, our family & divorce lawyers—and practicing mediators—are proud to serve much of northern Alberta, including the following communities:

- Edmonton & Area – Sherwood Park, Beaumont, Leduc, Fort Saskatchewan, St. Albert, Spruce Grove, Stony Plain.

- North – Athabasca, Morinville, Westlock, Gibbons, Barrhead, Redwater, Peace River, High Level, Fort McMurray.

- West – Drayton Valley, Edson, Hinton, Whitecourt, Devon.

- South – Camrose, Wetaskiwin, Millet, Calmar.

- East – Vegreville, St. Paul, Cold Lake, Bonnyville, Vermillion, Wainwright, Tofield.