Real Estate Law in Alberta

The article answers some basic questions about legal real estate transactions in Alberta, as well as described the basic steps associated with a purchase, sale, and refinance of a property. Keep in mind that this is legal information – not legal advice. Every real estate transaction is unique and the earlier in the process you speak to a real estate lawyer the more likely they help you avoid any potential issues along the way.

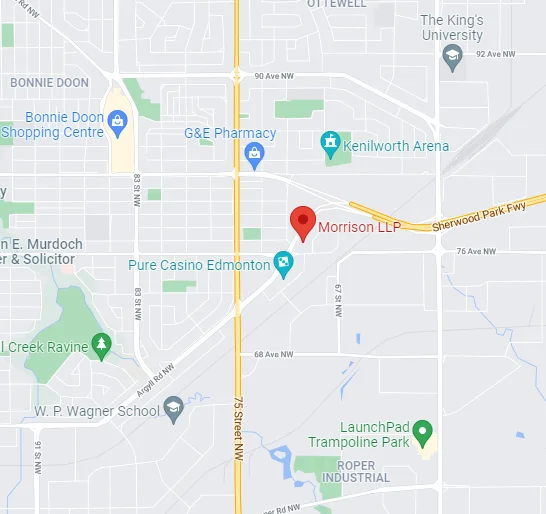

Whether you are a first time homebuyer, downsizing for retirement, or refinancing because of a separation, call Morrison LLP at 587-758-1099 to speak with a lawyer about your real estate transaction.

Why Do You Need a Lawyer for Your Real Estate Deal?

Most people do not realize they need a lawyer to buy, sell, or refinance a house. Not only are they fundamental to completing the transaction but they can be invaluable in guiding you through the process. A lawyer works with you to:

- Navigate the numerous land titles procedures and ensure all documents are registered properly;

- For a purchase, prepare all the mortgage documents required by your lender;

- Spot potential pitfalls that could delay or even derail your deal and help you to avoid them.

Get your deal on the right track and call Morrison LLP at 587-758-1099 to speak with a lawyer about your real estate transaction.

How Long Does a Real Estate Deal Take to Complete?

Every real estate deal is unique but they all have a set closing date. The closing date is the date when your contract dictates that the deal must close and keys are exchanged. On average a real estate deal takes approximately a month to be completed between the acceptance of the contract to keys being exchanged. However, a lot can happen in that month. This is why the earlier you get a lawyer involved the better for you.

Get a lawyer on your side now to help guide through the biggest transaction of your life. Call Morrison LLP at 587-758-1099 to speak with a lawyer about your real estate transaction.

How Much Does a Real Estate Lawyer Cost?

Many are surprised to discover they need a lawyer to buy or sell their home and are unsure of the costs. At Morrison LLP we offer:

- Fixed fees at affordable rates for purchases, sales, and refinances;

- A free consultation to get your deal on the right track;

- Transparent disbursements – No hidden costs;

To complete your real estate deal at an affordable price call Morrison LLP at 587-758-1099 to speak with a lawyer about your real estate transaction.

What are the Different Types of Real Estate Transactions?

Buying a House in Alberta

Buying house is one of the most important, yet stressful, purchases a person will make in their lifetime. For many, the interaction of the numerous key players, the large sums of money involved, and tight deadlines can seem daunting. Although every real estate transaction is unique, the home buying process tends to follow these basic stages:

Stage One – Initial Preparation

This initial phase involves assembling all the key players to prepare for the upcoming purchase. Your realtor will need to determine what you are looking for in a house in order to narrow the search parameters. The bank or mortgage broker will need detailed financial information to determine the mortgage they can offer. Your lawyer will ensure that any issues or pitfalls are dealt with as early in the process as possible.

Stage Two – The Offer

Now that you have found a house, it’s time to put in an offer. The offer, the first draft of which is usually written by your realtor, contains all of the important terms of the contract including the purchase price, the deposit, any conditions or additional terms, and closing date. Since the initial offer sets the stage for the rest of the negotiation and transaction it is often beneficial to have a second set of eyes, such as your lawyer, review it prior to sending to the sellers. Once the offer or any counter offers are accepted by both parties the transaction enters the conditional period.

Stage Three – The Conditional Period

The conditional period, the time between the signing of the offer and the condition date, provides the buyer with both time and access to the property in order to determine if they will proceed with the purchase. Once the conditions are waived, the contract will be final and failure to complete the purchase could result in legal consequences for the buyer including losing their deposit.

Stage Four – Meeting the Lawyer

Once your conditions have been waived, the focus shifts to your lawyer to finalize the transaction. Your lawyer will begin preparing all of the necessary conveyance documents for the Land Titles Registry, as well as all of your mortgage and finance documents. After the documents are finalized you will attend their office to sign everything and discuss your closing in detail before the big day.

Stage Five – Closing Day

A whole series of events now occurs in the background at your lawyer’s office, including receiving mortgage funds, sending the cash to close and submitting your documents for registration all of which culminates is your keys being released to you.

For more detailed information, please see our article on Buying a Home.

Selling a House in Alberta

Stage One – Initial Preparation

This initial phase involves assembling all the key players to prepare for the upcoming sale. Your realtor will need to assess the market for similar properties to determine the optimal sale price. Your lawyer will be ensuring that any issues or pitfalls are dealt with as early in the process as possible. You will need to ensure you have a number of documents and information about the property ready for when your lawyer and the buyer inevitably requests them.

Stage Two – The Offer

Now that you have an interested party they will put in an offer. The offer, the first draft of which is usually written by the buyers realtor, contains all of the important terms of the contract including the purchase price, the deposit, any conditions or additional terms, and closing date. Since the initial offer sets the stage for the rest of the negotiation and transaction it is often beneficial to have a second set of eyes, such as your lawyer, review it prior to accepting it or sending a counter offer to the buyers. Once the offer or any counter offers are accepted by both parties the transaction enters the conditional period.

Stage Three – The Conditional Period

The conditional period, the time between the signing of the offer and the condition date, is usually more important for the buyer as they are usually granted access to the property in order to determine if they will proceed with the purchase. For the seller it is a great time to tie up any loose ends that may have been overlooked during the hasty offer stage. Once the conditions are waived, the contract will be final and failure to complete the purchase could result in legal consequences for the buyer including losing their deposit.

Stage Four – Meeting the Lawyer

Once the buyer waives conditions the focus shifts to the lawyer to finalize the transaction. Your lawyer will begin preparing all of the necessary conveyance documents for land titles. The important sale documents require originals so you will need to attend their office to sign everything and discuss your closing in detail before the big day. Then your lawyer will compile all the necessary documents and sent out a trust letter to the buyer’s lawyer prior to closing day.

Stage Five – Closing Day

A whole series of events now occurs in the background at your lawyer’s office, including receiving the cash to close, paying out your mortgage, paying your realtor commissions, and authorizing the key release all of which culminates in the sale proceeds being deposited in your bank account.

Who Are the Key Players in a Real Estate Transaction?

The Realtor

What does a realtor do? A realtor is often your first point of contact when you begin the process of buying or selling a house. Initially, they will also be the main point of contact between you and the other side at least until your lawyer is involved. A good relationship with a realtor is helpful in ensuring the transaction goes smooth. This is especially true for buyers because they rely on the realtor to find them a house that best suits their unique needs. Keep this in mind before signing any exclusive representation or listing agreement with a realtor.

The realtor will often draft the initial offer as well as waivers and amendments. However, there is nothing wrong, especially if there are potential issues with the property, with having a lawyer review those documents before signing.

The Lender/Mortgage Broker

For most people, buying a house in cash is unfortunately beyond their means. This is where a lender comes into the picture. A lender can be a bank, a financing company, or another individual with the financial ability to lend funds to the buyer. Lenders will require some security, usually in the form of a mortgage to be paid back over time with interest, in exchange for advancing you the funds needed. Many people will simply obtain their financing from their current banking institution which is usually the simplest solution. However, there are other lenders out there which can offer people access different rates.

This is where a mortgage broker becomes useful. A mortgage broker will compare lender rates to find you a potentially more lucrative lending rate. Though not always the case, the more obscure the lender the more documentation and paperwork they will require to obtain the mortgage. Depending on the timeline to complete the purchase, it is important to keep this in mind when deciding on a lender with your mortgage broker.

The Real Estate & Property Lawyer

A lawyer will be involved in almost all types of real estate transactions. They are invaluable to spotting pitfalls in the transaction and helping to either prevent or mitigate those pitfalls. It is best to have your lawyer involved from the onset of the transaction so they can advise on any potential issues. They will be responsible for preparation of all conveyance documents as well as all mortgage documentation in the case of a buyer. The appointment with your lawyer is one of the most important parts of the process as they will be able to address any of your concerns and explain the process to you.

Key Information & Terms About Real Estate Transactions

Every real state transaction is unique and it is important to contact a lawyer early in the process to help you avoid any issues. However, whether you are buying, selling, or refinancing a home there are a few key concepts that will help

Certificate of Title and Registration

Property ownership in Alberta is governed by a land titles registry system. Every property has a corresponding Certificate of Title which is unique to that property. The Certificate of Title has important information such as the legal description of the property (which is different than the municipal address), the owners names, and the municipality in which the property is located.

Importantly, it also lists any encumbrances that are registered against the property including utility rights of way, easements, encroachments, or restrictive covenants (just to name a few).

These encumbrances can have a large impact on the usability of property and thus it is important to contact a lawyer early in the process to determine if any encumbrances on the title are detrimental to you.

Documents that affect a property, such as a transfer of land or a mortgage, must be submitted to the Land Titles Office for registration. For example, if you are selling a home you will need to sign an original transfer of land with your lawyer. On the completion of the sale that transfer of land will be submitted to the Land Titles Office and, assuming there are no errors or issues, a new certificate of title will be prepared and issued in the name of the buyers. Both the Certificate of Title and entire registration process are key aspects of property ownership in Alberta and serve to simplifying the process of real estate transactions.

The Land Title Registry requires original “wet ink” signatures for the majority of its documents which unfortunately means that you cannot simply sign with a digital signature. Thus, a trip to your lawyers office is usually required.

Conditions

Most real estate contracts, even after being signed and accepted by the buyer and seller, are still conditional. This means that until the conditions are either met or waived by the party they are in favour of, the contract is not final. If those conditions are not met or waived by the condition date then the contract is usually void. Although conditions can be placed on a contract by either the buyer or the seller, the majority of the time the conditions are placed on the contract by the buyer and thus must be waived by them. These commonly include a condition for the buyer to obtain financing, a condition allowing the buyer to inspect the property, and, in the case of condominium purchase, a condition to allow review of the condominium documents.

As mentioned, although it is far less common, there is nothing prohibiting a seller from placing a condition on the contract. For example, a seller who currently has a tenant residing on the property may insist on the condition that the tenant has ended their lease and moved out in order to avoid any issues with a delay in the sale.

The conditional period, the time between the signing of the offer and the condition date, often provides the buyer with both time and access to the property in order to determine if they will proceed with the purchase. Once the conditions are waived, the contract will be final and the buyer and seller are both obligated complete the transaction. Therefore, it is extremely important, especially for the buyer, to ensure they are satisfied that all their conditions are satisfied prior to waiving them.

Taxes

Properties are assessed by a municipality, usually once a year, to determine the updated assessment value for the purposes of levying property taxes. The assessed value is dependent on a number of factors including, but not limited to, location, lot size, type of structure built on the lot, proximity to amenities or parks, and other intangibles such as unique aspects on the property. at which point the new assessed value is provided to the owner. This new assessed value will be used to determine the property taxes owing for that property. Property taxes are also levied once a year, the timing of which is unique to each municipality, and are often due within a few weeks thereafter. For example, the City of Edmonton taxes are levied around mid May and property taxes are due June 30.

Property taxes are levied once a year but people sell and buy properties the whole year. Thus, the taxes must be adjusted, based on the date of closing, for the majority of real estate transactions. For properties sold during the first half of the year, before annual property taxes are levied, the buyer will eventually pay the annual property taxes and must be reimbursed for the fact that they did not own the property. It is the exact opposite for properties sold during the second half of the year, after taxes are levied, because the seller (hopefully having paid taxes in full) now needs to be reimbursed for remainder of the year they will not own the property.

Joint Tenancy vs. Tenancy in Common

When two or more individuals purchase a property they must choose to register as either as joint tenants or tenants in common. The key difference between the two tenancies is what occurs upon the death of either party.

Joint Tenancy

When one owner dies in a joint tenancy the other owner has a right of survivorship and deceased owners’ share of the property automatically goes to the surviving owner. In order to affect that transfer the surviving owner must file an affidavit of surviving joint tenancy with the Land Titles Office.

Tenancy in Common

A tenancy-in-common means the owners have a distinct percentage share of a ownership in the property. For example, tenants-in-common could split the property such that each has a 50% ownership or one tenant could have 30% and the other 70% ownership. These percentages are whatever the owners have agreed upon. Importantly, when one owner dies in a tenancy-in-common the other owner has no automatic right to other share of the property. The deceased owners’ share will go to their estate not to the other co-owner.

Dower Act

In Alberta, married couples must ensure the adhere to all the requirements of the dour act when dealing with their property. The Dower Act plays an even more prominent rule when only one spouse is registered on the certificate of title or in cases of a divorce. In those cases, the individual not currently on the certificate of title will often need to sign additional documentation, relating to the Dower Act, in order to ensure the transaction can be completed. Individuals should consult their lawyer early in the process of buying, selling, or refinancing a property in order to ensure they properly adhere to the Dower Act requirements.

Red Flags to Avoid in Real Estate Transactions

Whether you are buying, selling, or refinancing there are many issues that can arise during a real estate transaction. Each transaction is unique and faces is its own unique issues. Thus, this is not an exhaustive list of all the issues that can arise but rather a list of some of the major pitfalls to avoid during your real estate transaction.

No RPR and Compliance

The standard form real estate contract in Alberta requires that the seller provides a real property report and it’s corresponding municipal compliance certificate to the buyer before the closing day. Thus, the RPR and compliance both play a pivotal role in the majority of real estate transactions. One of the biggest pitfalls a seller can encounter is neglecting to obtain the RPR and compliance before listing their property. There are circumstances where a a seller may not wish to obtain an RPR but that decision should be discussed with a lawyer prior to accepting an offer. The majority of the time a seller will want to arrange with either their realtor or lawyer to obtain an RPR and municipal compliance in advance. Buyers in a transaction must also be mindful of the RPR and municipal compliance as it can have significant impacts on their mortgage advance.

Regardless of whether you are the buyer or seller you should consider discussing the RPR and municipal compliance with your lawyer to avoid any issues with the transaction.

Unexpected Registration on Title

One of the most difficult issues to deal with during a real estate transaction is discovering an unexpected or problematic registration on certificate of title. Problematic registrations could include any of the following:

- A restrictive covenant that severely restricts the use and enjoyment of the property;

- An unexpected mortgage that a seller did not realize was on title;

- A right of way or easement which allows for adjacent properties to traverse over the current property;

- A lien on the property for construction work done or unpaid taxes.

In most cases, these issues can be dealt with and resolved without adversely delaying the transaction. Usually the more time your lawyer has to deal with these issues the more likely they can be solved before the closing day. Therefore, it is important to retain a lawyer early in the transaction to deal with these unexpected issues.

Delay in Insurance

You should always have home insurance…that is just part of owing a house. However, it is also pivotal to obtaining financing. For any purchase of a home where you obtain a mortgage you will be required by your lender to have home insurance. Specifically, the lender will require their information to appear as “First Loss Payee” on the binder letter or insurance policy. A delay in this will inevitably lead to a delay in your funding which will delay your closing. Therefore, once you have waived conditions it is a good idea to start the process of obtaining home insurance to ensure no delays.

Contact a Real Estate Lawyer Today

We hope you found this legal information helpful. Feel free to call us at Morrison LLP at 587-758-1099 if you have any questions about your real estate transaction—the first 30 minutes are free.

Although we are based in Edmonton, our real estate lawyers are proud to serve much of northern Alberta, including the following communities:

- Edmonton & Area – Sherwood Park, Beaumont, Leduc, Fort Saskatchewan, St. Albert, Spruce Grove, Stony Plain.

- North – Athabasca, Morinville, Westlock, Gibbons, Barrhead, Redwater, Peace River, High Level, Fort McMurray.

- West – Drayton Valley, Edson, Hinton, Whitecourt, Devon.

- South – Camrose, Wetaskiwin, Millet, Calmar.

- East – Vegreville, St. Paul, Cold Lake, Bonnyville, Vermillion, Wainwright, Tofield.